Rumored Buzz on San Diego Home Insurance

Rumored Buzz on San Diego Home Insurance

Blog Article

Safeguard Your Home and Loved Ones With Affordable Home Insurance Plans

Relevance of Affordable Home Insurance

Safeguarding economical home insurance coverage is vital for safeguarding one's property and monetary wellness. Home insurance offers security against different risks such as fire, theft, natural catastrophes, and individual responsibility. By having an extensive insurance strategy in position, house owners can feel confident that their most significant financial investment is shielded in the occasion of unforeseen conditions.

Budget-friendly home insurance not just provides economic security but likewise provides tranquility of mind (San Diego Home Insurance). In the face of increasing building values and construction expenses, having an economical insurance coverage ensures that homeowners can conveniently rebuild or fix their homes without encountering substantial financial problems

Moreover, budget friendly home insurance can additionally cover personal valuables within the home, offering repayment for things damaged or stolen. This coverage prolongs beyond the physical framework of your house, safeguarding the materials that make a residence a home.

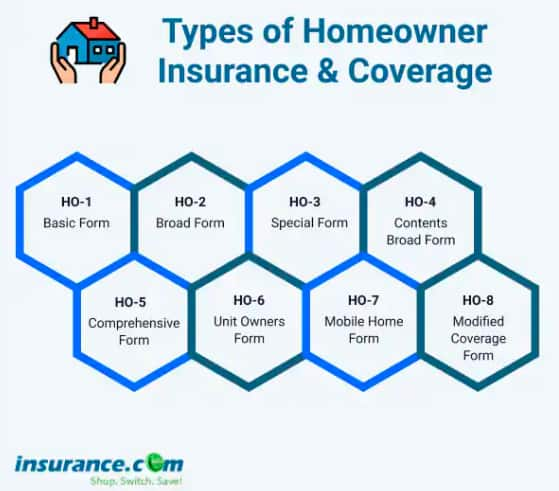

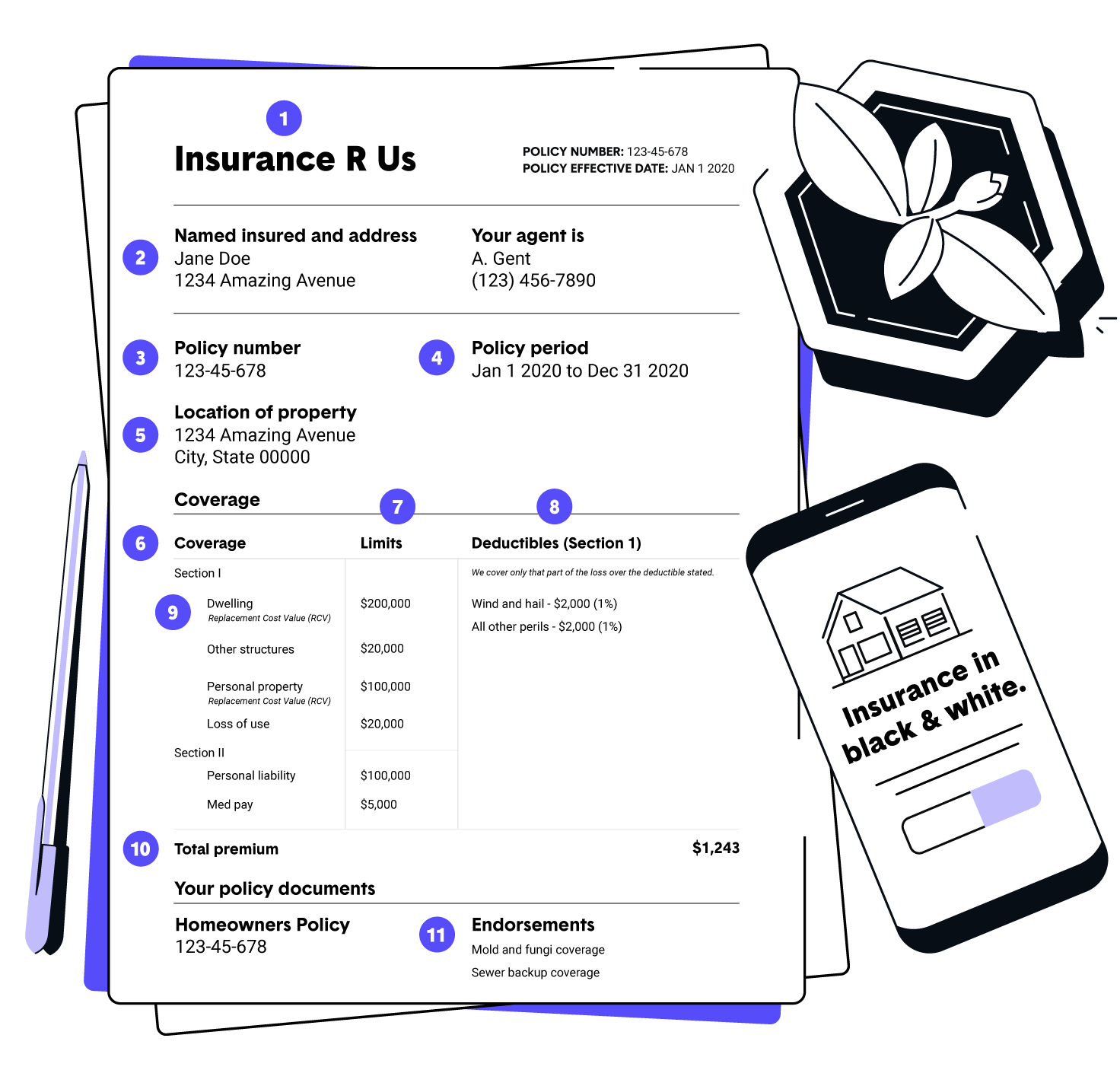

Coverage Options and Boundaries

When it involves insurance coverage limits, it's important to comprehend the maximum amount your plan will pay out for each and every kind of protection. These limits can vary depending upon the policy and insurance company, so it's vital to review them meticulously to ensure you have ample defense for your home and assets. By understanding the protection options and restrictions of your home insurance coverage policy, you can make enlightened choices to secure your home and liked ones properly.

Aspects Affecting Insurance Policy Expenses

Several variables substantially influence the prices of home insurance coverage plans. The place of your home plays an essential function in determining the insurance premium. Homes in areas prone to all-natural calamities or with high crime prices usually have greater insurance policy expenses due to enhanced risks. The age and condition of your home are also aspects that insurance companies take into consideration. Older homes or properties in bad condition may be a lot more pricey to guarantee as they are much more at risk to damages.

In addition, the kind of protection you pick straight impacts the price of your insurance plan. Choosing for added insurance coverage options such as flooding insurance policy or earthquake protection will boost your costs.

Additionally, your credit report, declares history, and the insurer you select can all affect the price of your home insurance coverage. By taking into consideration these factors, you can make enlightened choices to aid handle your insurance coverage costs properly.

Contrasting Quotes and Companies

In enhancement to contrasting quotes, it is essential to examine the credibility and monetary stability of the insurance coverage carriers. Look for client reviews, rankings from independent companies, and any type of history of issues or regulatory actions. A reliable insurance policy supplier ought to have a good record of promptly processing insurance claims and offering outstanding customer support.

Additionally, think about the certain insurance coverage features provided by each service provider. Some insurance firms might use additional benefits such as identification burglary protection, tools breakdown protection, or coverage for high-value items. By meticulously comparing quotes and providers, you can make a notified choice and select the home insurance strategy that finest fulfills your requirements.

Tips for Reducing Home Insurance Coverage

After extensively comparing quotes and suppliers to find the most suitable insurance coverage for your requirements and budget plan, it is prudent to discover effective techniques for saving on home insurance. Several insurance policy firms supply discount rates if you buy numerous plans from them, such as combining your home and automobile insurance. Routinely evaluating and updating your plan to mirror any kind of changes in your home or circumstances can guarantee you are not paying for insurance coverage you click now no longer need, aiding you conserve cash on your home insurance premiums.

Final Thought

Finally, safeguarding your home and enjoyed ones with cost effective home insurance coverage is important. Comprehending coverage choices, restrictions, and aspects influencing insurance prices can aid you make informed decisions. By comparing carriers and quotes, you can locate the most effective plan that fits your requirements and budget. Applying ideas for reducing home insurance can likewise help you secure the necessary security for your home without damaging the financial institution.

By untangling the ins and outs of home insurance coverage plans and exploring useful techniques for securing affordable coverage, you can guarantee that your home and loved try this out ones are well-protected.

Home insurance plans usually provide several protection alternatives to shield your home and personal belongings - San Diego Home Insurance. By comprehending the protection choices and limits of your home insurance coverage plan, you can make educated choices to protect your home and enjoyed ones properly

Regularly assessing and upgrading your plan to reflect any kind of modifications in your home or scenarios can ensure you are not paying for coverage you no longer requirement, assisting you conserve money on your home insurance premiums.

In final thought, safeguarding your home and liked ones with economical home insurance coverage is vital.

Report this page